Getting Thru the IRS Collection Maze

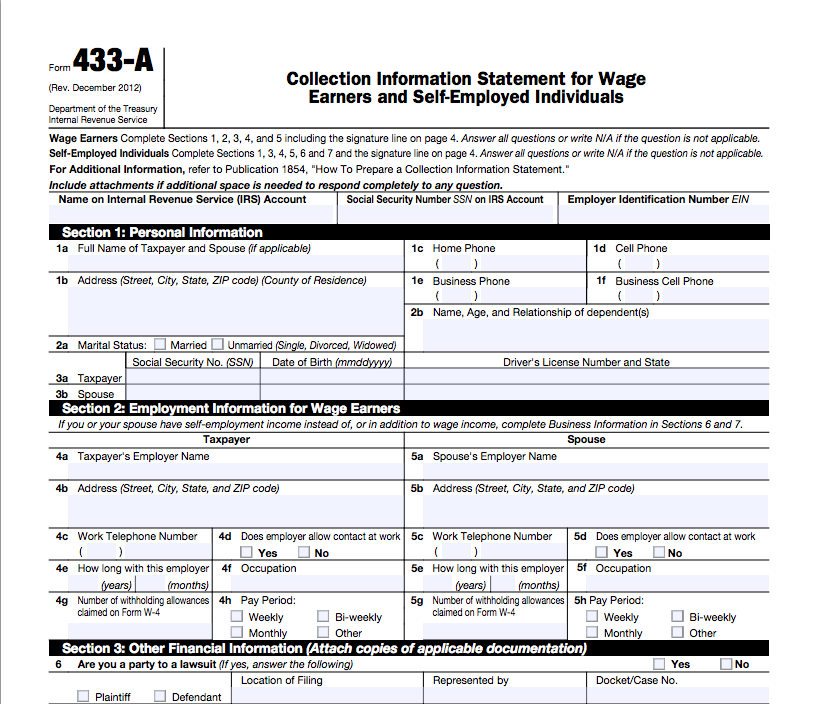

The twists, turns and switchbacks of the IRS collection maze are frustrating, confusing and daunting. Here are 5 insights on how to make it through the maze as quickly and easily as possible. Entering the Maze: IRS Collection Letters IRS Publication 594 sets forth a general description of the IRS collection process. It details what a […]